Family Wills

In family wills the aim of the maker of the will (testator) is to

make provision for loved ones i.e beneficiaries in the best way possible.

But how do you protect family members or dependents whose needs go beyond a straightforward material bequest and how can you safeguard their inheritance even beyond your passing?

The family members that particularly warrant special consideration in a last will and testament are:

- Minor children - especially in the case of single parents

- Any children (even adult children) with diminished capacity, whether an intellectual or physical disability

- A family member with a history of substance or alcohol abuse or dependency or any other form of addiction such as gambling

- Where there is a concern that a prodigal child may inherit a vast sum at too young an age and squander it, lacking maturity to manage it properly

- Where a family member is serving a prison term

- Where the possibility of a beneficiary being adversely/unduly influenced by a third party exists

Etc.

In other words, where the beneficiary is not old enough to legally own property and/or not equipped to control or manage the inheritance responsibly.

One structure that can be used very effectively is a testamentary trust will.

Incidentally, you can also set up a charitable trust in this way so your trustees can make tax-free donations to an eligible school, church, charity etc.

NOTE: It is vital to consult with a legal expert in your jurisdiction before creating a testamentary trust will for a disabled child, so as not to disqualify such a child from any government grants or benefits!

Free Family Wills that can be used to compile your own document and we will show you sample wording to make provision for a testamentary trust. But do explore the additional information and guidelines provided on our pages first to assist you in weighing up various options.

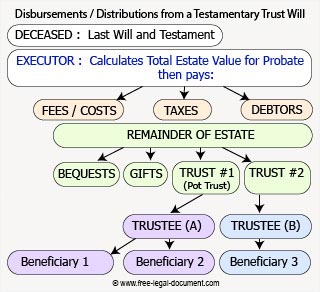

What is a Testamentary Trust?

It is a trust that will only come into existence upon the death of the trustmaker (after probate), through his last will and testament. Until that time, the will maker retains control and ownership of all the property, assets or money that may be bequeathed in his will.

And once this trust is created, an appointed trustee takes over the administration of your legacy, according to your wishes.

If you wish to have a testamentary trust (may also be called a child's trust) created upon your death, you MUST include provisions for this in your Last Will and Testament (or as an annexure or codicil to supplement an existing will, duly referenced).

Incidentally, other terms used for trustmaker are grantor or settlor or trustor.

Sidebar:

- In the UK it's called a Bereaved Minor Trust - it is restricted to your own children or step children who will inherit once they turn 18. Or it's called an 18-25 Trust if you wish to restrict it at most up to 25 years.

- In the USA (if applicable in your state) you can also use the Uniform Transfers to Minors Act (UTMA) as a method for transferring relatively small amounts of property to children. This custodial account can be managed by an adult until the child is old enough (varies by state, 18 - 25 years) to take ownership.

It is not a "living trust" because it does not exist during the lifetime of the trustmaker. It is "revocable" (at first) because the trustmaker or willmaker can at any time (whilst of sound mind) revoke his will and make a new will with different terms and provisions for the trust. Or omit any provisions for a trust if there is no more need for it e.g. minor children have reached maturity or have died before the trustmaker.

But once the testator (who is also the trustmaker) dies, family wills become fully enforceable and the terms cannot be changed.

And once the will passed through probate, the Testamentary Trust is irrevocable and cannot be modified or revoked without a court order. (The trustee and/or beneficiary will have to petition the court and will have to submit compelling reasons, such as a bequest being invalid, or the administration of the trust has become unreasonably expensive to maintain, or the purpose of the trust is no longer valid etc.)

Family Wills: Can I Have More Than One Trust?

Sure you can - and each one can be administered by the same or a different trustee, for example:

- A trust for a minor child where the trustee is a friend who is willing and capable to manage the trust

- A trust for a disabled child where the trustee is a relative who is in a position to oversee the care of the child

You can also have a single trust with more than one beneficiary (pot trust) e.g. a number of your children.

A pot trust could end when the youngest child reaches the minimum age specified (or graduates or fulfills any other condition set by you) and only then will whatever remains of the inheritance be shared. So, older children may have to wait a number of years before they can take ownership.

In this case (where there is more than one beneficiary) you may find that the trustee will use the money as needed and not necessarily equally amongst the children - pretty much how it happens with most families where parents are still alive. For example, an older child may be employed whilst a younger child is still at school and hence the younger child's needs may require more funds from the trust.

You can distribute all of your assets into trust(s) or only a portion of your assets and in any ratio you wish. However! There may be laws in your jurisdiction against disinheriting a child or spouse that you need to explore. (For example the right of the child to maintenance before attaining majority status.)

You can also split up the assets bequeathed to a single beneficiary e.g. a portion given to a person is to be distributed outright and free of trust when he reaches age 21 and the remainder held in trust until he turns 25.

Example of the Distribution of Assets in Family Wills

What Happens in Family Wills with No Mention of a Testamentary Trust?

Minor children do not have legal authority to own property. That's law.

So if you bequeathed any property to a child and there is no surviving spouse and no provision for a testamentary trust and no nominated trustee, then:

USA- If the inheritance exceeds the amount that can be placed in a custodian or savings account for a child (varies by state), a judge will appoint a conservator to manage and control the inheritance.

UK- The Court will appoint a trustee if a will maker neglected to do so.

South Africa- Any assets will be liquidated and all monies paid into a Guardian's Fund. The money will be invested conservatively until the child becomes an adult. (Incidentally, the Guardian's fund only receives cash. So if you want to ensure a child inherits a family home or stamp collection or artwork, you need to make sure you've made provision for that in your will.)

Canada- Funds may be managed by the Accountant of the Superior Court of Justice or by the Public Guardian and Trustee who employs a Trust Administrator to oversee trusts at a fee.

Australia- State trustees or an independent administrator may be appointed by the Court.

An eligible person e.g. grandparent, can apply to the court to be appointed as trustee but will not necessarily be successful with the application. You can avoid so much of this hassle by making provision for a trust and nominated trustee in your estate planning!

As for adult beneficiaries - If there is no testamentary trust in your family will, then any inheritance will automatically become theirs when the estate is wound up. So the adult family members you were concerned about will not have the protection of assets that a trust can offer.

Related Information on Family Wills and Testamentary Trusts

* How long does it take to create a testamentary trust?

* What are the duties of the trustee?

* Can a beneficiary be a trustee?

* How will the trustee spend the money?

* Can you decline being a trustee?

* How does one dissolve a testamentary trust?

* How to create this document

* Sample wording to create a trust in a will

* Examples of instructions to trustees

* Whether probate is necessary

* Testamentary Trust vs Living Trusts ("inter vivos" trusts)

You are here: